Mechanics of Investing

September 25, 2023 by Alan Szepieniec

Mechanics of Investing in Neptune

This note summarizes the framework for investments up until now, as well as going forward. If you are not interested or not in a position to make an investment at this time, this note will be of little use to you. But we decided to share it regardless, in the interest of transparency and in order to avoid confusion in the future. None of the information in this note constitutes investment advice.

1. Corporate Entity

The company spearheading the development of Neptune is called Triton Software AG and is domiciled in Zug, Switzerland. It (currently) employs three full time engineers. Triton Software AG exists only to give birth to Neptune; after bringing Neptune to life it will relinquish control. Money is a project that no-one should be in control of.

2. Exchange

Investors do not acquire equity; instead, they buy rights to future tokens. These tokens are premine tokens: they will be minted into existence by the genesis block when the network launches. Premine tokens are locked for 6 months, after which they can be transferred to another address.

3. Tokenomics

The genesis block will mint 831'600 Neptune tokens, corresponding to 1.98% of the asymptotical limit on the token supply (42'000'000). Every three years, half of the remaining supply is mined competitively. See the tokenomics page for more details.

The premine is divided into a portion for advisors, and a portion for bounties, and a portion for investors. The entire 1.98% premine will be minted by the genesis block regardless of how much is sold by that time. The remainder goes to the company, which can (after a six months waiting period) transition from selling the rights to future tokens to selling actual tokens. The tokens not sold by 2026 will pass to the founders and early employees.

4. Price

We prefer not to commit to a token price because the price we are willing to sell at depends on many factors including how far we are on the roadmap and what the investor brings to the table beyond money. To enable some orientation we can share the following details:

- Total amount of investment money received: CHF 1'079'450.51

- Current (2023-09) premine distribution:

- allocated to advisors: 18'295.2

- allocated to bounties: 60'000

- allocated to investors (sold): 117'834

- still for sale: 635'470.8

Dividing the total amount of money received by the fraction of the premine that was sold gives a previous valuation of the premine: CHF 7'618'099. Since the company's only source of revenue is this premine, this number doubles as a previous valuation of the company.

Another method for deriving a token price would be to start from a fully diluted value of the entire network, for instance by determining Neptune's appropriate rank on coinmarketcap and dividing that number by the token supply limit. We disagree with this method (see here for a criticism) but it is worth mentioning because this is the prevalent strategy by which other investors operate. In particular, if you are looking to exit by selling to other investors, you ought to know their pricing strategy.

5. Next Steps

If you are thinking about making an investment, please reach out to the founders, Alan and Thor (@neptune.cash).

Update, 2025-06-10

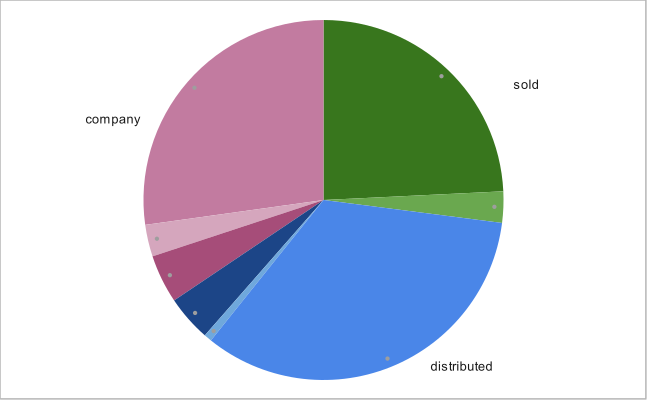

As of 2025-06-10, the updated numbers regarding the distribution of the premine are as follows.

- Sold: 224'808 NPT

- for fundraising: 201'474 NPT

- for payment in kind: 23'334 NPT

- Distributed: 320'472 NPT

- to founders and early employees: 280'351.67 NPT

- to employees as salary: 5'833.33 NPT

- to partners (advisors, money finders, bounty hunters): 34'287 NPT

- Company: 286'185 NPT

- remaining bounty pool / external developer fund: 36'200 NPT

- new bounty pool / external developer fund: 23'800 NPT

- unallocated: 226'185 NPT

Of the coins sold, 23'334 were sold in exchange for services in kind, typically related to marketing activities. The remainder was sold in the pre-sale at an average price of 10.4 CHF / NPT. The most recent sale price was 20 CHF / NPT.

The bulk of the distributed coins are allocated to founders and early employees (F&EE) in accordance with their vesting plan. The remaining portions are allocated to future salaries for employees and partners. The latter class includes advisors, money finders, and bounty hunters.

The company continues to own roughly one third of the premine coins. Of the initial 60'000 NPT pot set aside for bounties and external developer activities, 23'800 has been claimed. That pot is hereby replenished. The remainder of the company's assets will be sold to fund further development of the Neptune Cash blockchain, including wallet, application, and cryptography. Should any of those coins remain in the hands of the founding company at its dissolution, this remaining part will be distributed to founders and early employees in alignment with existing contracts.